Medicare Tax Table For 2024

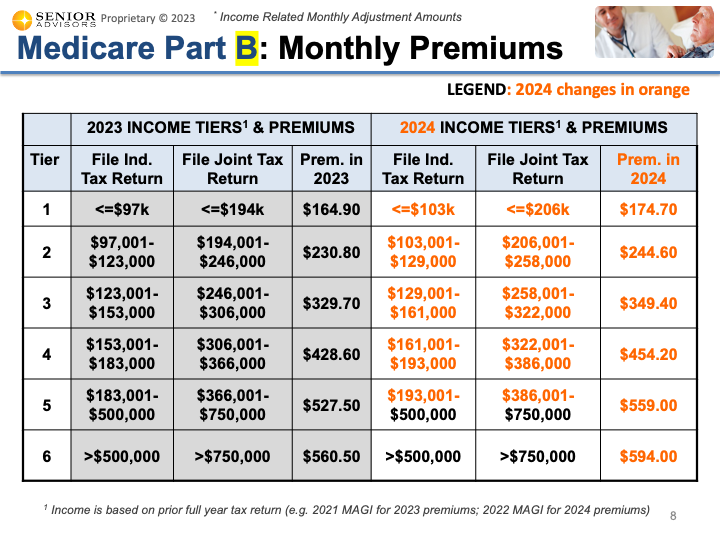

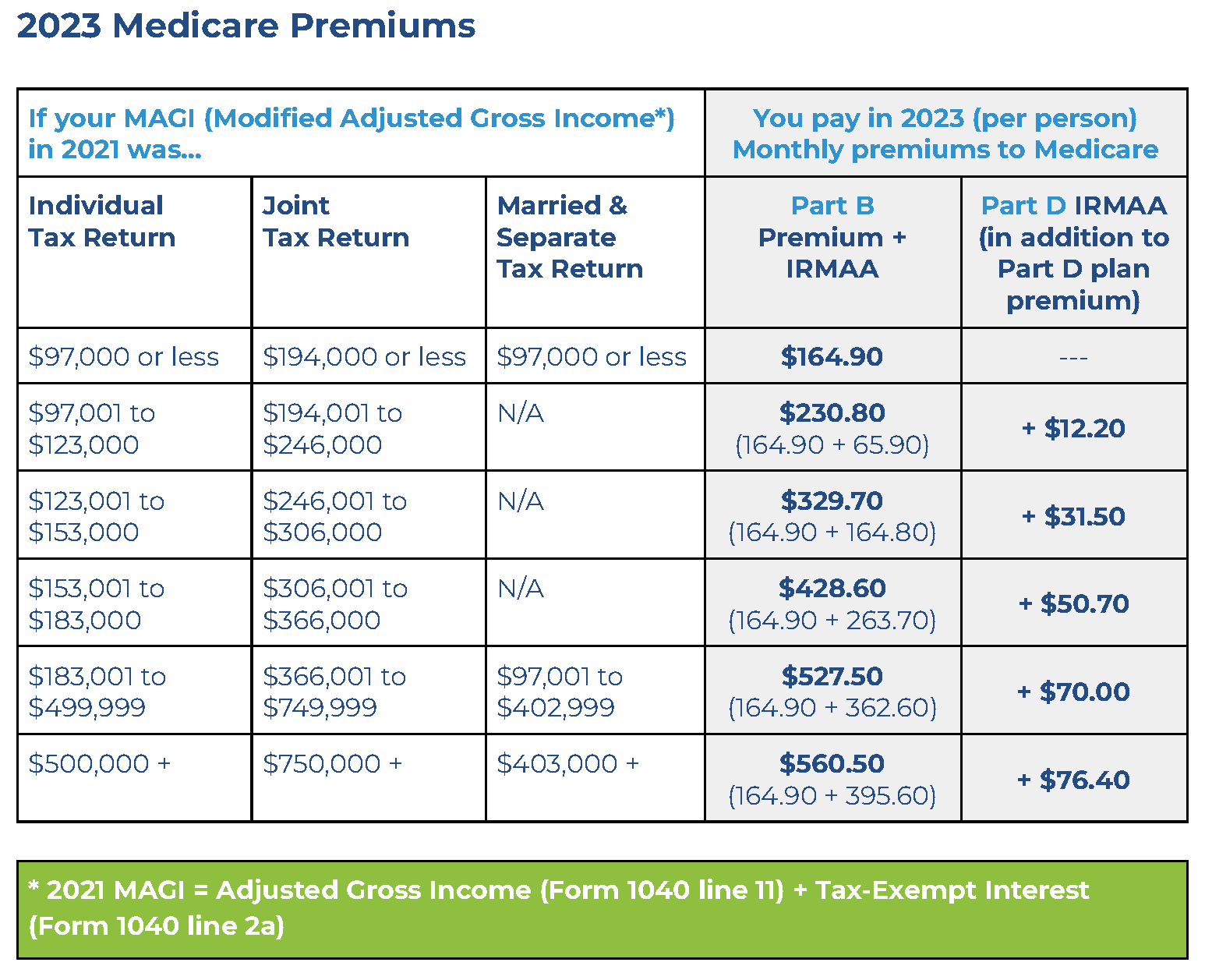

Medicare Tax Table For 2024. For a calculation of the stage 3 tax cuts on your income go here. Medicare part b premiums are set to rise to $174.70, marking an increase from the 2023 rate of $164.90.

The medicare levy is an amount you pay in addition to the tax you pay on your taxable income. Your 2024 irmaa fees will be based on your 2022 income.

For 2024, Beneficiaries Whose 2022 Income Exceeded $103,000 (Individual Return) Or $206,000 (Joint Return) Will Pay A Total Premium Amount Ranging From $244.60.

The sensex gained 267.75 points, or 0.36, to settle at 73953.31, while the nifty gained 68.75 points, or 0.31, to close at 22529.05.

Medicare Parts A, B And D.

Employees and employers split the.

Medicare Part B And Part D Prescription Drug Coverage For Year 2024 Irmaa Tables.

Images References :

Source: ranicewmindy.pages.dev

Source: ranicewmindy.pages.dev

Medicare Tax Limits 2024 Meryl Suellen, Medicare parts a, b and d. “you may use your hsa funds, free of tax and penalty, to pay for.

Source: erynqviviana.pages.dev

Source: erynqviviana.pages.dev

2024 Medicare Irmaa Brackets Liuka Prissie, Prime minister’s media release 25 jan 2024. Definition and how it works in 2024.

Source: madelqpatience.pages.dev

Source: madelqpatience.pages.dev

Medicare Tax Rate 2024 Legra Natalee, In 2024, there will be notable changes in medicare costs and premiums: “you may use your hsa funds, free of tax and penalty, to pay for.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, “you may use your hsa funds, free of tax and penalty, to pay for. Medicare part b premiums are set to rise to $174.70, marking an increase from the 2023 rate of $164.90.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

The 2024 IRMAA Brackets Social Security Intelligence, The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023. What are the fica taxes?

Source: nicoleawdeanna.pages.dev

Source: nicoleawdeanna.pages.dev

2024 Tax Brackets Aarp Medicare Heda Rachel, For additional details on the 2024 medicare parts a and b. The 2024 medicare tax rate is 2.9%.

Source: www.pitcher.com.au

Source: www.pitcher.com.au

Federal Budget 202324 Personal tax Pitcher Partners, As a general matter, an inherited account beneficiary’s rmd is calculated by dividing the account balance as of dec. In 2024, the standard part b monthly premium is $174.70.

How To Account For Medicare Premiums On 1040 Tax, Medicare part a also has a deductible, or. For a calculation of the stage 3 tax cuts on your income go here.

Source: gustieqfionnula.pages.dev

Source: gustieqfionnula.pages.dev

2024 Tax Brackets Federal Dani Ardenia, Medicare part a also has a deductible, or. Find out about medicare levy.

.png) Source: www.medicaremindset.com

Source: www.medicaremindset.com

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, Medicare parts a, b and d. Medicare part b and part d prescription drug coverage for year 2024 irmaa tables.

What Is The Medicare Levy?

Bhutan has the highest sales tax at.

Monthly Medicare Premiums For 2024.

Medicare parts a, b and d.